The Federal Government has issued a “January surprise” as it raises import duties on commodities and drugs entering Nigeria. A sample of new import duties include

1. Sugar 10% to 70%

2. Alcohol 20% to 60%

3. Rice from 10% to 60%

4. Cement 10% to 50%

5. Fabrics 35% to 40%

6. Second Hand cars 10% to 35%

Also included in import rate hikes are antimalarial and antibiotics drugs.

The rate hikes are designed to support import substitution policies by the government and also raise revenues. By taxing imported rice and sugar for instance, the hope is that imported commodities becomes more expensive and thus demand shifts to local rice substitutes boosting local production and sale of rice and creating local jobs.

This is putting the cart before the horse.

Import substitution works where there is a local “substitute” that can take up the fall in supply of imported brands when their costs go up. Let’s take rice, local production of rice cannot meet local demand, thus if you tax rice imports, the price of rice imports will go up. thus the prices of local rice will also go up as demand shifts to local rice, solidify food inflation.

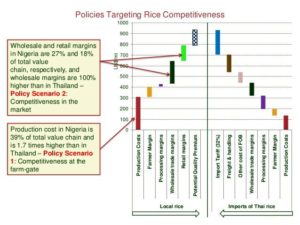

To reduce local prices, local production has to go up. The government efforts at import substitution should thus focus on the local commodities value chain with a strategic goal of boosting harvests, processing and availability of local substitutes. Once production is up, and cheaper local substitutes is available in the market, imports will drop, prices will fall. Taxing imports without a corresponding local substitute is counter intuitive. So the question the economic team must address is why rice can be exported from say Thailand, with international freight and insurance paid, distributed in Nigeria and yet be cheaper than Kebbi and Anambra produced rice.

In a reports by the International Food and Policy Research Institute by Xianshen Dia & Kwabena Brempng in 2012, Production costs in Nigeria for rice were calculated at 39% of total value chain and 1.7 times higher than Thailand. The paper further states that “doubling rice import tariff rate (to 100%) only modestly raises domestic rice production and at a tariff rate of 400%, rice production only increases by less than 20%”

So what is the rationale of imposing tariffs on imported sugar when according to the National Sugar Development Council report in 2010 put local production capacity of 0.03 MMT or 2% of local demand then put at 1.41 MMT? A report by the dailies in March 2016 reviewed the performance of three sugar importers (Dangote, BUA and Flour Mills) who signed an agreement with the FGN to backward integrate their sugar value chains, with a goal of producing 1.797MMT to meet total local demand and halting import. At the date of the article only Dangote was producing with a projected output of just 18000 metric tonnes. so why increase import tariffs? when local production is nowhere near meeting local demand.

A way forward is a massive investment in of key rural agriculture zones. Agriculture in Nigeria is still manual and rainfed, transport of harvest to key markets is still sub-optimal and inefficient….modern storage infrastructure are insufficient, commodity markets nonexistent, all these must be addressed.

To boost local production…the Federal and State governments have to coordinate better with specific responsibilities.There has to be a firm strategic handshake between Ministries of the Federal government, for instance, take rice, Works and Power Ministry should build rural access roads and power schemes to facilitate local processing, Agriculture Ministry provides improved seeds, Finance Ministry creates a private sector run commodities exchange and Private Equity funding for rice mills, Transport Ministry links Kebbi rice markets by rail to the rail grid, Water Ministry secures irrigation assets etc these direct intervention drops local costs and support the sector, improving yield, only then can the Trade Ministry imposes tariffs on imported rice.

In Summary, we have to take a strategic view, taxes on imports means alone won’t do it.

(Picture Credit: International Food Policy Research Institute)

Kalu Aja is a Financial Planner and economic strategy consultant with over 18 years’ expertise in the financial services industry. He runs a financial advocacy blog; www.kaluaja.com which focus on personal financial and the economy. his handle is @FinPlanKaluAja

Join BusinessDay whatsapp Channel, to stay up to date

Open In Whatsapp