Oil extended declines to the lowest in a year on fears the fast-spreading coronavirus will take a major toll on the global economy.

Futures in New York fell 1.4% after plummeting more than 7% over the previous three sessions.

Top U.S. health officials on Tuesday warned of a domestic outbreak of the infection, triggering another sell-off on Wall Street and in commodities. South Korean cases topped 1,200 from just 51 a week ago, there have been 11 deaths in Italy and the tollis mounting in Iran.

Investors are struggling to gauge whether the virus will turn into a global pandemic and how severe the economic impact will be.

A meeting of the Organization of Petroleum Exporting Countries and its allies next week is taking on even greater significance as the market waits to see if the alliance will agree to deeper and longer production cuts to counter a slump in demand.

“It’s more and more about what this means for demand, and it looks like there’s more weakness to come in the short-term,” said Michael Poulsen, an analyst at Global Risk Management Ltd. “The big question is how wide and deep the impact of the virus is going to be.”

West Texas Intermediate for April delivery fell to $49.21 a barrel on the New York Mercantile Exchange as of 9:34 a.m. in London, after closing down 3% on Tuesday.

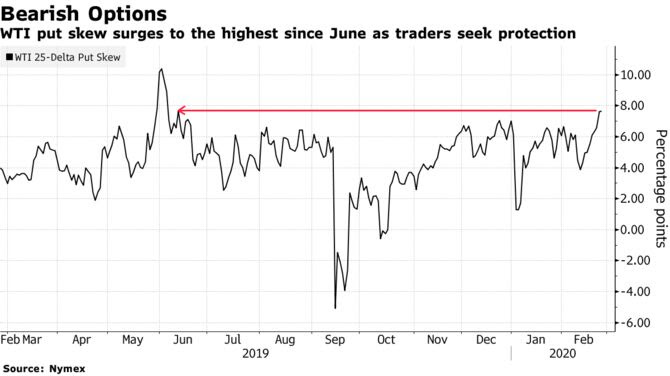

The so-called put skew — the premium traders will pay for options protecting against a drop in prices over those protecting against a rise — is at the highest level since June.

Brent for April declined 1.6% to $54.06 a barrel on the ICE Futures Europe exchange after dropping 2.4% in the previous session. The global benchmark crude was at a $4.82premium to WTI for the same month.

While the oil market is also struggling with rising supply. The American Petroleum Institute reported that crude inventories rose by 1.3 million barrels last week, according to people familiar with the data. That would be a fifth straight weekly build if confirmed by official government data later on Wednesday. A Bloomberg survey forecast a 2.6 million barrels rise, according to a Bloomberg survey.

Join BusinessDay whatsapp Channel, to stay up to date

Open In Whatsapp